The SDG financing gap will be history, when natural infrastructure (NI) enters the economics and financing computations.

Published on: 13/06/2019

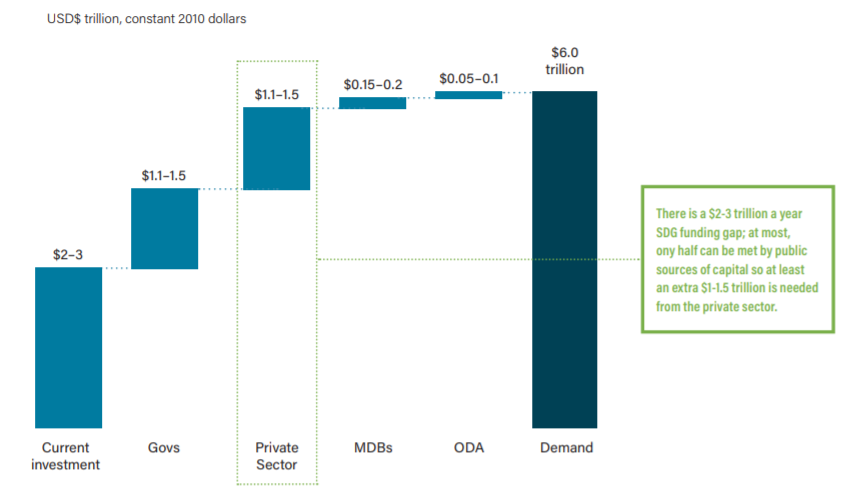

The Sustainable Development Goal (SDG) funding gap is estimated at US$ 2-3 trillion per year, which in itself a huge deficit, and difficult to bridge through conventional means. To meet the sanitation and hygiene targets of SDG 6 alone, the World Bank estimates an annual need of US$ 114 billion between now and 2030, three times the current investment levels. Naturally, there is a clarion call, to bridge the gap through budgetary sources, blended financing, donor support, higher global commitments and private sector. The poor are the worst affected by service delivery failures.

Source: Blended Finance Task Force, 2018

Undoubtedly, a large chunk of these investments will invariably go to finance physical /grey infrastructure. The mindsets, the systems and the governments are all focusing on the hardware role, disregarding the immense value and recuperative strength of natural infrastructure such as wetlands, river basins, aquifers, soil, biodiversity, the ecosystem and the like, resulting in double jeopardy, viz., (i) making the infrastructure investments unsustainable and dysfunctional; (ii) missing opportunities in leveraging, reinforcing and supplementing Nature Based Solutions (NBS) in achieving SDGs. There are many distorted investment priorities such as the construction of dams, when the aquifer is empty, ignoring traditional water sources for distant complex high cost supplies; subsidising unregulated ground water extraction that undermines soil fertility; flood irrigation, when simple measures to improve soil moisture would yield better results; setting up dysfunctional water treatment plants and leaking distribution networks when natural systems to improve water quality are more sustainable.

Huge service delivery dividends can be attained when the natural infrastructure is valued and integrated with physical infrastructure to attain the SDGs, including those for water resources, food security and agriculture, biodiversity, environment, urban water security and climate change. Unfortunately, natural infrastructure is considered to be less efficient, riskier and slow, and their ecosystem functions are less understood. Ecosystem services will provide system-wide solutions that make investments more sustainable and cost-effective over time. The critical challenge is, how to overcome the inertia and resistance and to incentivise integration of natural capital into the project cycle.

There is growing body of evidence, supporting both academic and practical interest in NBS and natural infrastructure. The UN system of Environmental–Economic Accounting, Wealth Accounting and Valuation of Ecosystem Services Initiative (WAVES) of the World Bank and UN Environment/UNU Inclusive Wealth Index (IWI), have all contributed to the emerging thinking. Though the efforts hitherto are valuable, the process of functional integration at policy and financing levels are still elusive.

There is an urgent need to make the 'value' of nature more visible and measurable, integrating the externalities and linkages into the planning, financing, budgeting and development decision making. The following action framework would certainly accelerate the process:

Integration of natural infrastructure is not too costly at the aggregate levels, especially when the cost of wasted and unproductive hardware investments due to inadequate leveraging of natural infrastructure is taken into account. Instruments like 'polluter pays', green bonds, betterment levy, compensatory tariff, cost recovery, crowd funding and blending can all top up financing. The exercise can be simple and practical, similar to the rational decision making process of a farmer while leveraging every possible resource within his scope, to maximise yield. Public authorities, however, are in a more advantageous position to converge at watershed, landscape or river basin levels. Necessarily, there may not be one-to-one correspondence on benefits at project level, but multi-level governance and basin approach would create larger collective efficiency and sustainability gains. The process is iterative and methodological advancements need to be cautious, in alignment with the governance quality and institutional capacity. Communities and local governments can seize the opportunity to set frameworks and models based on simple tool kits. One such example is Mazhapolima, a community-based well recharge programme, initiated by the Thrissur District Administration in Kerala, India.

Time has come for fundamental re-thinking of infrastructure financing practices, adopting the principles of cost of capital, welfare trade-offs, value for money, accountability, transparency, system integrity and service delivery. Finance departments in governments and multi-lateral financial institutions could accelerate achievements by developing pro-active and positive conditionality and project financing instruments.

The wealth of a nation is much more than what its people can produce. The SDG financing gap will be history, when natural infrastructure enters the economics and financing computations.

At IRC we have strong opinions and we value honest and frank discussion, so you won't be surprised to hear that not all the opinions on this site represent our official policy.